The recent (July 5-6) WSJ Editorial title ("No One Is 'Gutting' The Safety Net", p. A14) had all the earmarks of clever sophistry, but it took a careful reading to confirm it. Therein, I detected these giveaways to the specious arguments made to try to nulllify the worst parts of Trump's Megabill giveway to the wealthiest. (Let us note here that a specious argument is one that has the apparent ring of truth but in fact is deceptive, misleading.)

We begin with:

1) "Medicaid spending has risen by roughly 60 percent since 2019 and the bill's sole intent was to bend that spending back to the 'bad old days' of 2020."

Here, the WSJ editors play fast and loose with economic facts, specifically trying to get the unwary reader to expect medical spending on a large population not to increase rapidly. In other words, ignore the entire arena of ongoing medical inflation - from prescription drugs to lab tests, to treatments (including for cancers), to exams to nursing care and serious long term care, e.g. kids with cerebral palsy, epilepsy or other physical debility - which require extensive caretaking. Hospital care alone, including treating serious diseases like Covid, influenza, accounts for nearly one third of Medicaid spending. Meanwhile, prescription drugs make up another one fourth, and while the number of prescriptions per Medicaid enrollee has decreased, net spending on prescription drugs has risen. Why? Because Big Pharma continues to raise the prices of their drugs.

Do the editors really expect such expenses to remain static? If so, they need to terminate themselves because no one that ignorant ought to be writing for a financial journal.

Another canard:

2) "Don't buy the Democratic talking point that the working poor will be lost in red tape as they try to prove they're on the job."

In fact, the difficulty is not "proof they are on the job", most on Medicaid already are, if only as caretakers of sick or disabled family. For example, a 2015 Forbes article highlighted how 40 million family caregivers in the U.S. are putting their own careers on hold to provide unpaid care — sometimes for decades. The estimated total value of the care has been put at nearly $1 trillion. This isn't reckoned into the GDP.

The bugbear is actually in completing the necessary forms online twice a year. A major impediment glossed over by the Righties but which John Oliver describes in brutal detail, including the critical need for home health care, personal medical assistants:

John Oliver on Trump’s ‘big beautiful bill’: ‘Death by a thousand cuts’ | John Oliver | The Guardian

More disingenuous twaddle:

3) "Democrats and some Republicans have offered cynical distortions that pregnant women in poverty and disabled children will suffer. But Republicans are trying to address the program's enormous Obamacare expansion to prime age adults above the poverty line."

Here we have for once the bare truth - NOT "cynical distortions" (1st sentence) - combined with the real basis for the editors' chicanery. That is, using a backdoor method to gut the ACA. In John Oliver's last show (link in (2)) we see a couple who are "prime age adults" - but making only $20,000 each. Barely above the current poverty line - but then that poverty line remains lowballed as it has since the late 60s. As the couple makes clear, they would not be able to afford their meds minus Medicaid (via Obamacare), and also the roof over their head, far less groceries. So what the WSJ editors have cynically done is target "prime age" adults barely a hair above the poverty line to try to justify cutting Medicaid for all who accessed it via the ACA expansion.

And yet more misinformation:

4) "The other main provision is tamping down state scams to Hoover up more federal dollars."

El wrongo! States have no 'scams' to hoover up money other than what has already been earmarked for them to spend to support their Medicaid residents. What the WSJ editor really means to say is:

"The other main provision is tamping down state Medicaid needs to enable more tax cut money for the richest."

As I already noted, Colorado alone will be hit with a $ 1/2 b shortfall it will have to make up, most likely by severe cuts - including to pregnant woman and with disabled children. The Office of State Planning and Budgeting has estimated Trump's Megabill will decrease state revenues by as much as $500 million but also increase costs to the state by around $500 m. Even if the Trump farce hadn't passed, nonpartisan economic forecasters estimate the state will face a $700 m deficit meaning a host of cuts - to Medicaid, education, health services etc. will be needed. The most critical cuts would likely be to home health care.

And the final chunk of codswallop which is hard to swallow:

5) "The bill's changes to food stamps are also modest and rooted in the tenet that work is central to upward mobility."

Nope, total hogwash. The bill's changes are far from modest -cutting the Supplemental Nutrition Assistance Program by 20 percent. As I noted in my earlier post about this travesty:

"This vile bill which passed the House and is currently in the Senate, would require states to pay 75% of the cost to administer the Supplemental Nutrition Assistance Program, or SNAP, which offers low-income people a monthly allowance to purchase food.

Currently, the federal government splits the cost evenly with states. If the ratio shifted, Colorado would have to come up with an additional $47 million to fund the workers at county human services departments who determine SNAP eligibility.

The bill would also require states to start paying a share of the food benefits themselves. The state estimates it could have to come up with anywhere from $130 million to $259 million annually to pay its share, depending on the language in the final bill. Colorado can’t come up with that amount of cash.

The cuts may force some states to lower SNAP eligibility or cut access to the program altogether. Could local food banks fill the gap? Not a chance. As one food bank manager told John Oliver, SNAP generates more than 4 times the food support as food banks. So there's no way food banks could make up the difference. (As Mr. Oliver notes, "They've not long survived a global pandemic").

John Oliver also makes clear that the work requirement (20 hrs. per week) is not the impediment, but rather the real 'millstone' is regular reporting requirement. Oliver cites a survey of people eligible but not participating in SNAP currently to show "40 percent were deterred by the paperwork involved. While another 37 percent said the paperwork was too time consuming given their family and work responsibilities."

I mean, Jeebus. Who's fooling who here?

People need to watch that segment especially as he notes the paperwork 'tweaks' alone will lead to more than 5 million losing at least some support from the SNAP program. One couple featured who earn $20,000 each and have five kids (the limiting income is $52k) said they remain ineligible because the paperwork demands extend to proving prior employment which the husband can't because the companies no longer exist. In John Oliver's words:

"So this bill is taking all that bureaucratic bullshit and making it worse."

The aim is to reduce federal spending on supplemental nutrition by $287 b over ten years - to allow the extension of the Trump tax cuts to the richest.

To do this, as Oliver notes, the bill expands the work proof requirements from the age of 54 to 64. In addition, the bill strips the current exemptions for veterans, people experiencing homelessness and those who recently came out of foster homes. So again, the bill's changes are "modest"? Total horse manure churned out by the WSJ op-ed nabobs, who confirm it when they babble at the end:

"Democrats think they can ride the Medicaid scare into a Midterm victory, but there's still time for the GOP to lay out the facts."

Problem is, the Trump Cult GOOPS have no 'facts', only delusions like their master, Donnie Bonespurs, and the clueless WSJ editors.

To get back to some measure of sobriety (and sanity) one needs to go to the Journal's regular pages, i.e. outside the delusional op-ed environs. Starting with the front page: 'Wall Street Worries About Crisis-Level Budget Deficits' - wherein one reads:

"The new legislation adds $3.4 trillion in federal deficits through 2034 compared to a scenario in which congress did nothing, according to the Congressional Budget Office."

Adding: "Republicans forged ahead anyway, defying warnings from Wall Street to Washington that they were pushing the country down a dangerous fiscal path."

That path begins and ends with the reactions of the bond market which will make the country pay for the folly of the Re-pigs. That will be when the tax cuts and spending are made permanent adding $5.5 trillion to deficits through 2024 - pushing debt to 127% of GDP. In effect, your children and grandchildren will become debt slaves to the bond markets paying off that debt in perpetuity.

See Also:

by Sarah Anderson | July 10, 2025 - 4:43am | permalink

by Sarah Anderson and Lindsay Koshgarian

The GOP’s “One Big Beautiful Bill,” which narrowly passed Congress and was recently signed by President Trump, represents the largest transfer of wealth from the poor to the rich since chattel slavery.

Here are just 10 of the worst things about it.

1. It’s going to kill people.

Cuts to Medicaid and the Affordable Care Act, combined with new administrative hurdles, could result in an estimated 51,000 preventable deaths per year. The new law and other actions by the Trump administration will strip health insurance from 17 million people.

2. It will be an apocalypse for rural hospitals.

The budget restricts the provider taxes that many states use to fund Medicaid. The threat is particularly severe for rural hospitals, which rely heavily on Medicaid revenue. More than 700 rural hospitals are already at risk of closure — and at least 338 are at increased risk due to changes in this budget.

3. It takes food from the mouths of hungry people.

New work requirements for SNAP benefits will take food assistance from millions, including children and veterans. As with Medicaid, new work requirements for SNAP will have little effect on employment, but will cause more children to go hungry.

4. It squeezes states on SNAP.

For the first time, states will have to take on a significant share of funding SNAP. This unprecedented shift will likely lead many states to cut enrollees or even terminate food aid altogether.

And:

by Les Leopold | April 29, 2025 - 5:05am | permalink

I recently wrote about a somewhat mysterious group of financial traders known as the bond vigilantes. Their actions caused Donald Trump to abort many of his Liberation Day tariffs, but that does not make them the good-guy defenders of democracy. In fact, they are quite the opposite.

Many understood that point, thankfully, but others wondered about the government bond market, how it worked, and why the value of something fully backed by the faith of the U.S. government might be mutable in value.

Readers had questions and the answers will help us understand why Trump flinched when the bond vigilantes drove up the interest rates on government bonds. As we shall see, what seems like a small change in interest rates has a very big impact on the value of outstanding bonds, causing the loss of trillions of dollars in a flash.

And:

Opinion | The bond market just sent a big warning for Trump - The Washington Post

Excerpt:

“Investors started dumping U.S. government bonds. They sold and sold and sold. This is not normal. Typically, U.S. government bonds are a safe haven. Whenever stocks tank or there’s turmoil around the world, investors rush to buy plain vanilla bonds from the U.S. Treasury. It’s the equivalent of chicken soup for unhealthy markets. But suddenly, those bonds turned bitter. Ultimately, Trump caved to the bond markets. He didn’t want to follow the fate of British Prime Minister Liz Truss, who resigned in humiliation in 2022 after a similar bond market fiasco in reaction to her policies.

This unsleeping, unfeeling, unsentimental voting bloc forced Trump to change course on his tariff tornado. Other forces sagged into exhaustion in the face of Trump’s obsession, but the votes of the bond markets kept piling up, second by second, hour by hour, day by day. Forget about memes, sick burns and capital letters on Truth Social. The market eschews parades and petitions and marathon speeches. It is an endless murmur of individual transactions, each one a vote, and a landslide swept Trump away.

Trump and his team tried to happy-talk their way past the stock market collapse, but the tireless voters weighed in. His attempt to brush off his defeat in the bond markets by saying that traders had gotten “yippy” fell flat. This is the world’s infrastructure of finance we’re talking about, and it’s built on the value of government promises. Yips have nothing to do with it.

And the pillar of this infrastructure is the credibility of the United States.”

And:

by Thom Hartmann | July 4, 2025 - 5:27am | permalink

Societies are typically organized along one of two lines: “We” or “Me.” We societies drive wealth and rights from the bottom up; Me societies do it from the top down, much like the kingdoms of old.

It’s a choice every nation must make. Franklin Roosevelt turned America into a We society with the New Deal; Reagan began the process of turning us into a >Me society with the Reagan Revolution. And his and the GOP’s efforts are now coming to full fruition.

Imagine this:

Your grandmother — 87 years old, Alzheimer’s setting in, barely able to recognize your face — is being wheeled out of the nursing home she’s called home for three years. Not because she’s better, but because the home is closing. The Medicaid funding dried up. The next available care facility is three hours away and it doesn’t take Medicaid. You work full-time. You have kids. You don’t have the money, or the time, or the training to care for her full-time.

And:

Attack of the Sadistic Zombies - Paul Krugman

Excerpt:

The belief that many Americans receiving government support are malingering, that they could and should be working but are choosing to be lazy, is a classic zombie idea. That is, like the claim that cutting taxes on the rich will unleash an economic miracle, it’s a doctrine that should be long dead. It has, after all, been proved wrong by experience again and again.

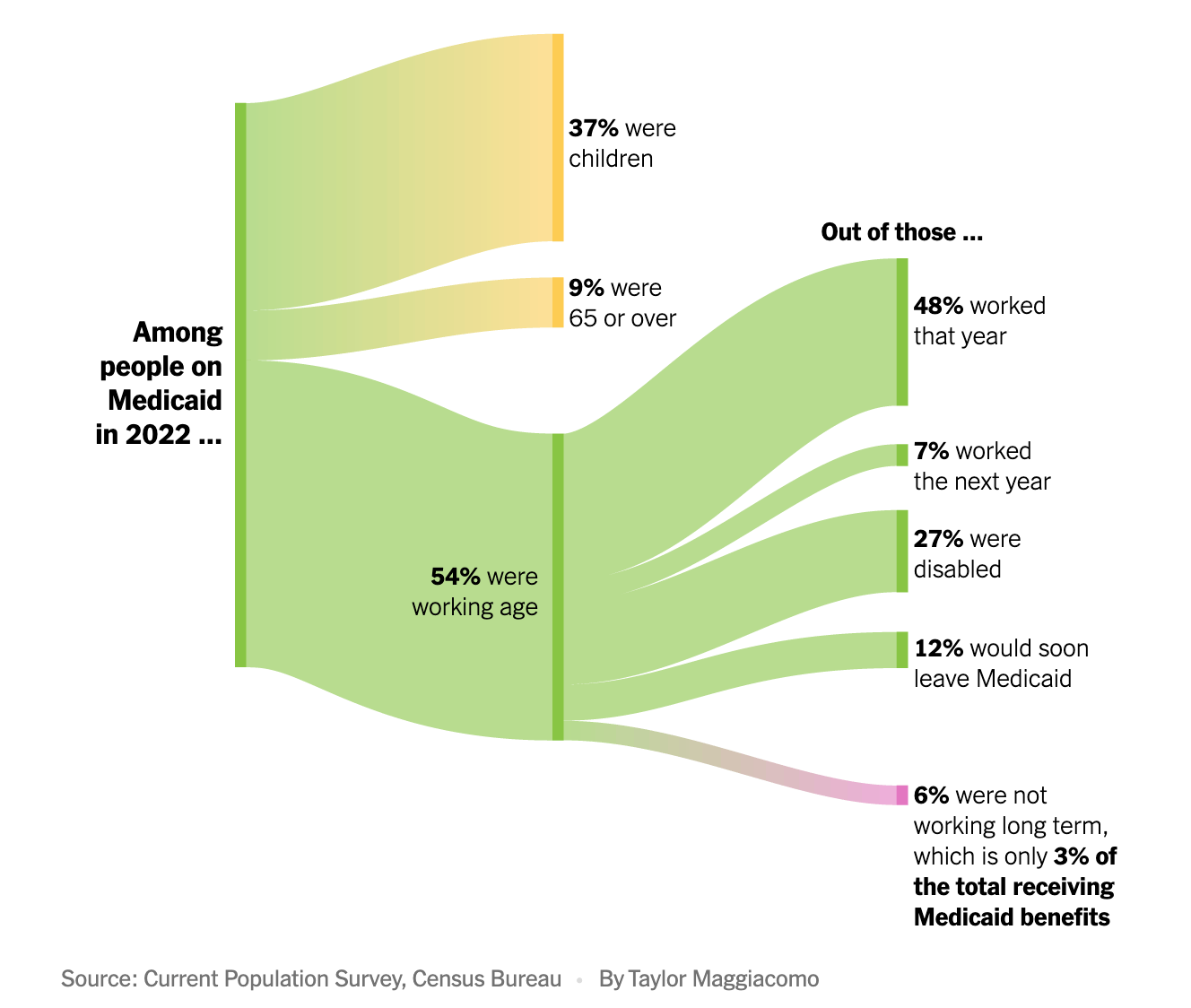

But right-wingers simply refuse to accept the reality that almost everyone on Medicaid is either a child, a senior, disabled or between jobs. A recent article in the Times by Matt Bruenig had a very illuminating chart:

Only 3 percent of Medicaid recipients were non-disabled working-age adults persistently not working — the kind of people right-wingers imagine infest the program. And it’s a good bet that a fair number of these people had extenuating circumstances of some kind.

As I see it, right-wingers’ rhetoric about the budget deficit is a lot like their rhetoric about antisemitism. It’s not something they actually care about. It’s just a club they can use to bash their opponents.

But in that case, why the cruelty toward less-fortunate Americans? Well, as I see it the cruelty, as opposed to the dollars saved, is actually the point. Inflicting harm on the vulnerable isn’t something they do with regret, it’s something they do with a sense of satisfaction.

And:

Opinion | GOP tax bill is a big, fat warning sign to bond market - The Washington Post

There are many unpopular features in the GOP’s One Big Beautiful Bill, including draconian cuts to Medicaid and food stamps, higher energy prices and trillions of dollars in additional debt. Both Republican lawmakers and President Donald Trump seem to realize this, given that they’re jamming the bill through with little time for the media (and, by extension, voters) to catch up to what’s in it.

They’ve also spent recent weeks smearing the refs, including the Congressional Budget Office and the Joint Committee on Taxation, the professionals tasked with crunching numbers on the bill’s consequences. And on Sunday, Republicans hid from the Senate parliamentarian to avoid hearing her latest rulings about the cost of their bill.

On Monday, GOP lawmakers went a step further. As they had previously signaled they might do, they voted to stop pretending to care about what the bill costs or what the parliamentarian rules. Instead, they simply declared huge chunks of it to be free. Here’s how:

The package’s tax provisions alone would cost, on net, $4.5 trillion over the next decade. But Republicans said, “Eh, most of that tax package [about $3.8 trillion of it] shouldn’t really count as costing anything.”

That’s because Republican lawmakers had passed similar provisions in 2017, which are scheduled to expire at the end of this year. Republicans argue that Americans got used to having that part of the tax code around. So extending these lower tax rates wouldn’t, you know, feel different.

As I’ve explained before, this is not how budgets work. It’s like saying renewing your Netflix subscription should count as free, because you got used to having the streaming service already. Or each time you buy another Starbucks coffee, it doesn’t cost you anything, because you’ve enjoyed Frappuccinos before. Or if your current car lease expires, getting a new one is now complimentary, because you already got used to the convenience of having a car.

Under this logic, it doesn’t matter if you’ve already allotted every penny of next week’s paycheck to other expenses (as Congress has). You don’t need to make room in your budget to pay for these goodies because you’ve gotten used to them.

The reason we’re discussing these arcane accounting acrobatics is that when Republicans first passed their regressive tax-cut package in 2017, they deliberately scheduled their tax cuts to “turn off” early, in 2025, rather than last forever. They did this to make the cost of what they were doing look smaller. What to do when those tax cuts expired — and how to pay for them — would be tomorrow’s problem.

But the tide might be turning. In May, Moody’s, the last outstanding major credit agency that had still considered U.S. debt to be effectively riskless, finally downgraded it. Moody’s specifically cited the expectation that Congress would extend these costly tax cuts — the ones that senators are calling “free” — as a reason for its decision.

No comments:

Post a Comment