"THE WORST PM WE’VE EVER HAD,” one London newspaper headline screamed.

The headline referred to Brit Prime Minister Liz Truss getting the 'heave ho' by her own Tory party Pooh Bahs after serving only 44 days. This became the shortest stint in UK history, in the wake of her cockeyed “mini budget” featuring £ 45bn of unfunded tax cuts which sent the sterling and gilt markets reeling. Truss, recall, had succeeded Boris Johnson as PM after winning a clear victory over Rishi Sunak in a ballot of Conservative Party members.

Two days later, Queen Elizabeth II died, and the nation entered a period of mourning and normal politics was suspended. Truss's political demise had already been sown - in then Chancellor Kwasi Kwarteng's mini-budget. Question: Why didn't Truss exercise oversight over the Chancellor of the Exchequer's mini budget? The only logical reason - as an alternative to gross ignorance or stupidity - is that she agreed with it. But as we've learned, supply side economics on which it's based never works, even if supposedly 'funded'. You need only go back to Arthur Laffer's 'Laffer Curve' and supply side dogma, aka "voodoo economics".

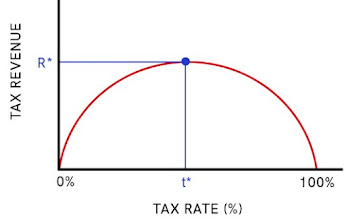

The Laffer curve, which one anecdote has Laffer sketching it on a napkin to explain to David Stockman is shown in simplest form below:

The infamous Laffer curve which has snookered Liz Truss

The question arose: How did he manage to sell the malarkey that HIGHER tax rates cause revenues to decrease? That's like saying or arguing that the more gas I put into my tank the less distance I will be able to travel! It makes NO sense! Laffer argued that higher tax rates on the rich would only cause them to work fewer hours, or if REALLY rich, invest in fewer projects, enterprises, hence create fewer jobs. Thus, revenues over all would decline, first from the working rich because Uncle Sam would get less taxes by virtue of their reduced work, and also from the investing rich because they'd create fewer jobs and thus no workers would be around to pay the taxes Uncle Sam wants. Thus, Laffer argued, the higher tax rates were Pareto Inefficient! See e.g.

But fortunately, enough economic real indicators

existed to test Laffer's curve on an empirical basis. Thus, given the substantial Reagan cut - from 70% to 50% by 1981, then down to 28% by 1988, it

should be possible to match the claims against economic reality. Especially,

one would expect to find lower debt % of GDP IF Laffer's claims were true. But it didn't hold up to scrutiny.

Economists James Medoff and Andrew Harless observed in their excellent book, The Indebted Society, 1995, p. 84, 'Let Them Eat Cake', that "high tax rates are associated with higher productivity growth" There is a consistent and strong relationship. By contrast, for the years when Arthur Laffer's supply side dogma held, productivity retreated by more than 30% and debt exploded- exactly the opposite of what Stockman had been sold.

Medoff and Harless noted (p. 23):

"For the health of the economy, Reagan's policies turned out to be just about the worst thing that could have happened: investment did not increase, growth continued to stagnate, and the federal deficit ballooned to new dimensions."The Laffer foolishness was tested again in the wake of the Bush (Jr.) tax cuts.. A Financial Times Analysis (9/15/10, p. 24) of the Bush tax cuts found:

"The 2000s- that is the period immediately following the Bush tax cuts – were the weakest decade in U.S. postwar history for real, non-residential capital investment. Not only were the 2000s by far the weakest period but the tax cuts did not even curtail the secular slowdown in the growth of business structures. Rather the slowdown accelerated to a full decline."

For reference, the top marginal tax rate during the Bush years (for income tax) was reduced to 36% from the 39.5% during the 1990s Clinton Years. Over the 1950s and into the 1960s (until about 1964) the top marginal rate was at 91%, going down to 65% by the mid -60s. The lower level of 50% wasn’t hit until Reagan arrived in 1980, and passed his tax cuts. And we've been piling up deficits ever since. The FT conclusion was blunt:

“Business investment data demonstrate the Bush tax cuts failed to achieve their goal of spurring productive U.S. investment and that failure has contributed to the poor performance of U.S. stocks”

So why are so many Americans still attracted to the "fun house math" of the GOP, to use the words of one TIME economist (after the FT analysis came out). She was nonplussed that so many had bought into (and evidently taken) the kool aid that the Reeps were selling: that the only way out of our economic malaise is to further lower taxes on the wealthy and businesses, and cut "entitlements". Can this be a disease? Well, probably a kind of mind virus.

And it isn't dead, because god awful mind viruses - like the real biological ones, e.g. Ebola - always seem to endure and get revived.

Now we have learned that GOP Minority Leader Kevin McCarthy - having wet dreams every night about becoming the next House Speaker- can't wait to try Laffer's curve again. He's calling the new revival, "Commitment to America". While cleverly dodging specifics we do know - thanks to Chris Hayes reporting on All In last night that:

- It will emulate the Liz Truss massive tax cut plan in the UK that already rendered her service the shortest in British history. (But as Hayes pointed out, there is no blowback for whatever economic perdition the Reeps sow.)

- In its first act it will send the new 87,000 IRS employees packing - meaning - if it ever passes, your phone efforts to contact the agency will be nixed, and tax refund backlogs and other problems will continue.

As Chris said after the segment: "If you think the chaos with Liz Truss and the conservatives in Britain is something, wait until Kevin McCarthy and his band of GOP misfits get control."

Bottom line: The Repukes have no clue, zero, about how to handle inflation if they get into congressional power again. All their "Commitment to America" is based on is the usual tax cutting - which as Liz Truss found out didn't work - and cutting back on IRS employment. Meanwhile, they entertain psychotic ideations of holding the Dems hostage to the debt ceiling - i.e. if they don't agree to cut Social Security and Medicare. This is the future - a sordid one worse than we have - independent and other poorly informed voters are betting on. And one which - if they succeed in getting the GOOPs in - will adversely affect the rest of us as well.

See Also:

Truss implosion shows big change in financial climate

And:

Why Truss resigned: A guide to the chaos

Excerpt:

A disastrous series of self-inflicted wounds — which turned into a political death spiral — began with a misfired attempt by the Conservative Party leader to radically reorient the government’s economic agenda, by slashing taxes without saying how the decision would be paid for. It sent the markets reeling, and Truss never recovered.

And:

by Peter Certo | October 22, 2022 - 6:29am | permalink

Excerpt:

Reports now say Republicans will pursue their usual plan: tax cuts for billionaires and corporations. Sorry, but how’s that going to help?

America’s billionaires have seen their wealth increase by $1.7 trillion since the pandemic started. If it’s “inflationary” when single moms like Maureen Bowling get help with their groceries and heating bills, isn’t it more inflationary when the absurdly rich get even more? And if you reward price gouging with tax cuts, won’t that just encourage more gouging?

And:

by Heather Digby Parton | October 20, 2022 - 8:11am | permalink

And:

by Joan McCarter | October 19, 2022 - 7:43am | permalink

If the GOP regains the House, four of the leading Republicans contenders for the House Budget Committee chair have all vowed to demand cuts to Social Security and Medicare in return for their cooperation in raising the debt ceiling next year. To be clear, that’s Republicans saying they will crash the U.S. economy to force President Joe Biden to give into their demands.

Now would-be House Speaker Kevin McCarthy has confirmed that yes, that’s exactly what Republicans intend to do. That continues to generate yawns from the super savvy reporters in D.C. and New York, who largely ignored the first reports of this threat. Now they’re continuing to try to downplay it. But it’s as real and as dangerous as can be.

No comments:

Post a Comment