Twenty years or so ago in Vegas if you hit a jackpot on one of the slots, say at Bally's, you'd see the cash - yes that cold hard stuff in the form of coinage (quarters, nickels, dimes) - pour out of the machine. Now, if you score a big win, you are most likely to see the "cashout voucher" such as shown above. That shows a piddling 7 cents ($0.07) , but imagine instead $407.00 just before the lever was pulled - this time by Janice two years ago at the Bellagio. And at one of her favorite slots, the Buffalo, e.g.

https://www.youtube.com/watch?v=vehR7xupnXg

I had warned her not to use the paper voucher to play because it obscured the money actually in hand, pretty much like debit and credit cards do for many in the populace. Yes, the tickets are an efficient way to use the machines- as well as making the gambling safer by reducing cash use - BUT they can also make you less conscious that you are dealing with real money. (Again, like too many with credit cards).

But Janice complained it was "too much trouble" to be converting back and forth from vouchers to cash and back. So just let her play on! Ok, so instead of getting her actual cash payout, she simply stuffed her entire $407 ticket in a different machine. This is also where the potential for mental error enters, because you see there are many kinds of slots, the penny (1c) ones, the five cent, the 25 cent, the dollar, the $3, the five dollar and the ten dollar. There are also differing bets that can be placed on each, For example, a 20 x bet on a $5 machine actually puts you at risk for a $100 loss if your spin goes nowhere.

In Janice's case, she didn't pay attention that the next machine was exclusively a $3 machine, not a 1 cent slot as she'd been playing. She just thrust her $407 ticket into the ticket slot and pressed a 50 x per spin bet, believing she had a 50 cent spin. In fact, it was 50 x $3 or 150 bucks gone in one pop. She then realized her huge error, cashed out the $257 ticket balance and went to the 1c slots, where she finally ended up losing $210 total - i.e. of the $407. The realization then dawned of how much REAL money she'd lost - equal to a whole week's pay for many - so she decided to pack up and leave to play another day.

Is there a lesson in all this? Yes, there is - given people can easily be duped or deluded if they cease being conscious that there is real, physical money behind the fancy vouchers or plastic media - like cards - they use. Most appalling, we seem to have a whole generation of kids sprouting up who haven't a clue what cash is or how it is used. (WSJ, 'Money Lesson For Today's Children: This Is A Dollar Bill', p. A1, Feb. 9-10.)

In the article there's a fascinating account of how a parent (Craig J. Harris) treated his daughter and some of her friends - for daughter Madison's birthday- with $25 gift cards each. This was to spend at a mall in Chicago. But as Craig tells it (ibid.):

"She had some friends who were just spending money willy-nilly and they ran out of money before they got to the second store. Some of the girls came up to us like, 'can you put more money on my card?' I was like, no, we gave you $25 already."

Anyone see the parallel between the kids' $25 gift cards and the Bellagio cashout paper vouchers? You should! In each case the medium lessens consciousness of the actual money supported so it is too easy to forget it's there while spending at a mall - or stuffing the ticket into another slot.

The same WSJ piece went on to note how Papa Harris tried to instill money lessons but still fell short. He cited his older daughter who was given a prepaid credit card and told to carefully think about her spending. Well, evidently she didn't because soon after her card was declined at a fast food restaurant for insufficient funds. In this case, while his daughter still rarely uses cash the lesson stuck. Well, it would because of the sheer embarrassment!

But this shows me the use of cash - in even small amounts - can teach kids more about the value of money than using credit or debit cards. By using real money in transactions kids are taught to value it more because it is now real to them. They can see it, hold it and even smell it. If they go on a buying binge they can also see how it is constantly diminished.

If the kids celebrating at the Chicago mall had been given $25 cash instead of the equivalent in cards, they'd have been forced to consciously parcel out their purchases as they beheld the real money dwindle. Say going to store one, and buying a sweater for $20, then seeing only $5 left in change. That'd be about enough to buy a burger and a coke and not much more. The point is they then wouldn't be hitting up the adults for more money because they treated the gift card in too cavalier a fashion.

That was how my brothers, sister and myself learned about money in our household. We each received $1.50 a week allowance to which we could add by doing extra chores. Usually, by the time I had ten bucks accumulated I'd take it to the hobby store down the street where I'd buy one or two airplane models. Before each actual purchase of a model, I'd venture into the store on a survey mission to find out the costs in advance, i.e. German Focke Wulf, $1.50; F-104 Starfighter interceptor: $2.75; Messerschmitt Bf-109 fighter, $1.75; Japanese Zero, $2.00.

In this way I knew in advance exactly how far my cash would go. Unlike today, one just didn't waltz into a store and start blindly buying (charging) whatever caught one's eye. Another reason kids today need to develop a cash- conscious mind even if they don't actually use it. (But they ought to still know what it is for, as opposed to some of the misfits cited in the WSJ piece- who asked their parents when given a cash gift: "What do I with this?" If you don't know you shouldn't go out into the world.)

All of which is more than ever relevant now as Americans have racked up nearly $4 trillion in consumer debt since 2013, including $1 trillion in credit card debt and $1.2 trillion in student loan debt. This according to a report on CBS Weekend News Saturday night. How did consumer debt reach such a misbegotten stage? Money manager and blogger Pete Adeney probably put it in the most blunt terms:

"A majority of people are clueless with money, and that's why a majority of people are unable to save for retirement and save for fun and are stressed out. The average person has great earning potential, and they do earn a lot over their lifetime. It can be $1 million or more, but it all goes out on stuff they don't even realize how expensive it is."

Which also kind of explains why so many citizens across the nation, not just here in Colorado, are having to rent out storage units for up to $180 a month to store all the expensive crap they've purchased, hardly ever see and don't use.

The thing about money, especially saving it, is that the lessons have to start early - with kids say 6 to 10 years of age. They ought to learn how to handle it and spend it in increments - and I do not mean being given plastic, but actual cash. (Say five 1's). Send 'em to the corner store to buy an item - say a pack of gum, or whatever- then count the change they get back. Do this over and over until they gain an appreciation for money, how to use it and how to manage it.

By the end of such training they ought to be as adept at using and managing their cash flow via allowance as say reading and writing - CURSIVE. Oh wait, that's another skill that's vanished from the culture with kids no longer able to even read granny's Xmas letters or cards. Maybe it's time parents restore a training on multiple key fronts, especially if their schools can't or won't.

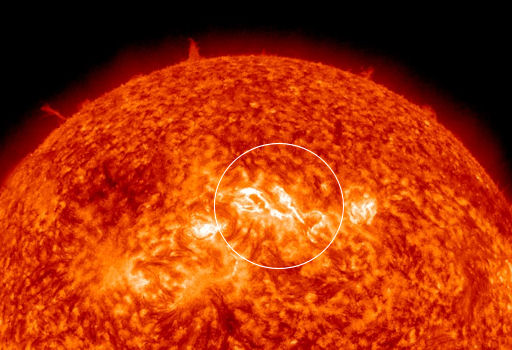

Besides, when that next massive coronal mass ejection hurls itself at us from the solar central meridian :

There's a good chance all electronics, including GPS service, will be out for a year or more. No smart phones, no computers, no debit or credit cards. What will little Missy or Monroe do then if they haven't learned how to use and manage actual cash...or read and write cursive?

Inquiring minds really want to know!

We live in a consumer culture of debt slaves conditioned by commercial propaganda. The value of money lords over the value of anything else to these people. Acquisitive success is the ultimate value. It's a very sad vicious cycle where one's extrication requires a Herculean effort. But once you're out, you cannot help but see the supreme absurdity of modern advertising...of Pop TV itself and The People's role in it all.

ReplyDeleteHere is an article that is worth perusing. https://www.counterpunch.org/2012/10/24/the-dark-age-of-money/

I hope you enjoy it.

Darrin

Very apt observations, Darrin, and thanks for that link!

ReplyDelete